Everyone Can Make More Money

Everyone across the income spectrum is capable of making more money. Money is a choice. Once you see that, you cannot unsee it.

“Why are we falling behind?”

Some people treat Thanksgiving as a warm-up for Christmas shopping. They stuff themselves with turkey, exchange a few pleasantries with family, and start spending.

Spend Your Money

We are all getting older. I’m faced with my own mortality every day when I look in the mirror—my hair has gone from 10% grey to 70% grey in the last two years.

Monkey See, Monkey Do

You’ve probably heard that people are quitting their jobs and getting rich trading cryptocurrencies.

I heard a story recently about someone who’d hired a crew of workmen to paint the house or fix the roof—something like that. They did a good job. Then afterward, they said they were quitting to trade crypto. People are really doing this!

Maybe you’ve even thought about it. You see other people getting rich, and you think, well, how hard could it be? It’s monkey see, monkey do.

-

Let me give you some advice: Do not quit your day job.

Back in 2004 or so, I was working for Lehman Brothers, and I remember reading a book at night called Trading for a Living. That was my aspiration at the time. Because, sure, you can make millions of dollars trading for a bank. But it’s still only about 1% of what you’re making for the firm.

When you trade for yourself, you get to keep all of it. But the stress load is exponentially higher. Most people find they’re unwilling to tolerate losses of any kind. So, they let themselves get stopped out of trades again and again. And they wind up slowly bleeding to death.

-

So, let’s talk about a smarter plan…

First, keep your job. Then, set aside as much of your take-home pay as humanly possible and invest it.

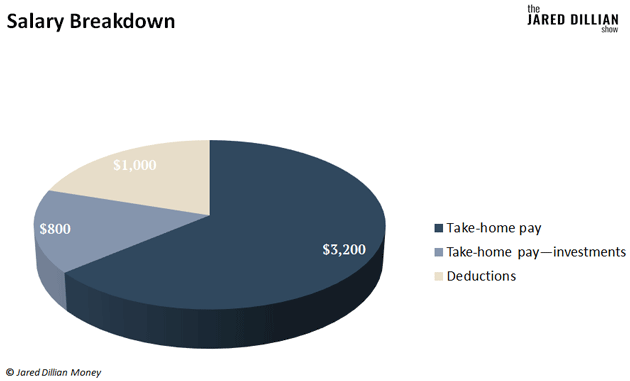

If you start doing this when you’re young, in your 20s, you should invest at least 20% of your take-home pay. For example, say your salary is $5,000 per month. About 20% comes out in taxes, Social Security, etc., and whatever is left is your take-home pay. In this example, we’ll say it’s $4,000. So, 20% of that is $800 a month.

If you can’t set aside 20%, look closely at your income and spending. Can you really afford your house? Are you spending too much on your car or vacations? Can you get a new job and make more money?

You are the only one who can answer those questions. But my guess is, you could set aside 20% of your take-home pay—and more is better. You might need to make some changes at first, but eventually, this will become a habit.

-

I can’t overstate the importance of investing as early and as much as possible.

It all goes back to a little thing called compound interest.

The simplest way to think of compound interest is “interest on interest.” Instead of just earning interest on your initial or principal investment, the interest you earn gets added back into the principal… and you earn interest on it as well.

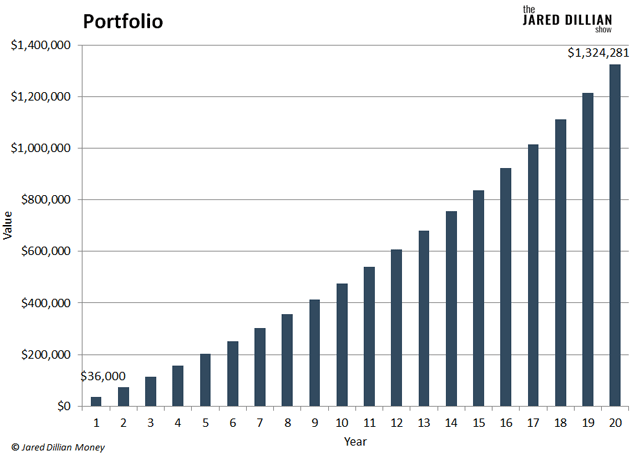

Compound interest makes a massive difference in your overall returns. Let’s look at an example.

Say you invest $3,000 a month, or $36,000 a year. Over the next 20 years, your investments return 6% on average. You keep all that money invested, and 20 years later… there’s $1.32 million in your account.

Not bad. And you did it without quitting your job. And without a lot of stress.

-

I talk about this all the time on my podcast, BE SMART…

My primary goal is to help you eliminate money stress. That’s why I want to hear straight from you about your financial worries—just drop me a note here.

I’ll address some of your concerns during my LIVE Q&A on Monday, November 15, at 1 pm ET. I’ve already saved you a seat—just check your inbox on the morning of the 15th for the link.

Jared Dillian

|

Everybody Has Stories About Shortages Right Now

Everybody has stories about shortages right now.

‹ First < 24 25 26 27 28 > Last ›